Term Life Insurance Basics

Now that youve learned the basics with this life insurance 101 guide it should be easier for you to make a decision about what type of coverage you should get. To better suit the unique needs of your family we have created different kinds of life insurance plans each with specific features and suitability.

I hope this life insurance basics guide was helpful in simplifying a topic that doesnt need to be so complex.

Term life insurance basics. Term life policies have no value other than the guaranteed death benefit. Term life term insurance is the simplest form of life insurance. Types of term life insurance.

Term life insurance is available for set periods of time such as 10 15 20 or 30 years. Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time the relevant term. There are several kinds of term life insurance.

Many term life policies give you the option to renew your coverage at the end of the term without undergoing another medical exam. The two main types are term life insurance and permanent life insurance. After that period expires coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions.

Find out more life insurance 101 basics in getting life coverage as a senior citizen. You can choose from our range of group insurance joint insurance and term insurance plans as well as opt for our policies focused on women and children. Term life insurance covers you for a set amount of time or term.

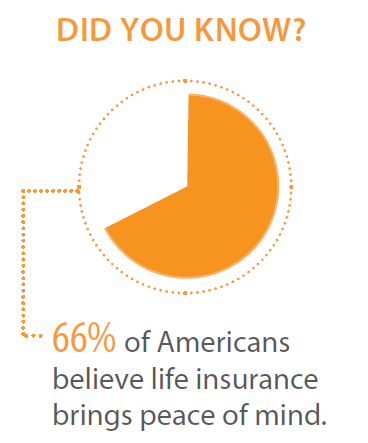

There are two main types of life insurance. For this reason its important for you to understand life insurance basics and to familiarize yourself with the various life insurance options available. The policys purpose is to give insurance to.

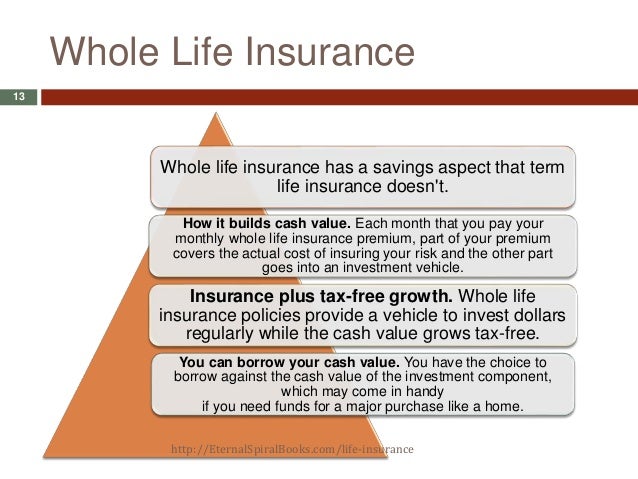

In the event of your passing life insurance coverage protects any people or organizations relying on your income. Types of term life insurance. There is no savings component as found in a whole life insurance product.

We welcome any comments below good or bad so this can continue to be improved as a valuable resource and starting place for learning all about life insurance. Types of life insurance. Term life insurance and permanent life insurance.

Term life insurance is the easiest life insurance to understand. Most term policies have no other benefit provisions. These terms are usually set in five year increments and typically last up to 30 years.

Types of life insurance. It provides death benefit protection without any savings investment or cash value components. There are two major types of life insuranceterm and whole life.

Level premium for the policys time period say 20 years your premium stays the same. It pays only if death occurs during the term of the policy which is usually from one to 30 years.

Beneficiary Cash Value Life Insurance Policy Endowment Policy Face

Beneficiary Cash Value Life Insurance Policy Endowment Policy Face

Life Insurance 5 Essential Things To Consider Aon Benefitsplus

Life And Health Insurance License The Basics Staterequirement

Life And Health Insurance License The Basics Staterequirement

Group Term Life Insurance The Basics And Why You May Already Have It

Group Term Life Insurance The Basics And Why You May Already Have It

Basics Of Life Insurance Terms

Basics Of Life Insurance Terms

An Unbiased Comparison Between Term And Cash Value Life Insurance

An Unbiased Comparison Between Term And Cash Value Life Insurance

Term Life Insurance Basics Quotacy Q A Fridays Youtube

Term Life Insurance Basics Quotacy Q A Fridays Youtube

Insurance For Undergraduates What Are You Covered For

Insurance For Undergraduates What Are You Covered For

Life Insurance Term Life Permanent Insurance

Life Insurance Term Life Permanent Insurance

Insurance Atsa Industries United States

Insurance Atsa Industries United States

Life Insurance Today S Learning Objective How Does Life Insurance

Life Insurance Today S Learning Objective How Does Life Insurance

Life Insurance 101 Basics For Beginners

Life Insurance 101 Basics For Beginners

Term Life Insurance Basics The Money Alert

Term Life Insurance Basics The Money Alert

The Basics Of Life Insurance The Florida Bar Member Benefits

The Basics Of Life Insurance The Florida Bar Member Benefits

Whole Life Insurance How It Works

Whole Life Insurance How It Works

Whole Vs Term Life Insurance Policygenius

Whole Vs Term Life Insurance Policygenius

Types Of Life Insurance The Basics Accuquote

Types Of Life Insurance The Basics Accuquote

Term Life Insurance Insurance Select Group

Term Life Insurance Insurance Select Group

Life Insurance Basics Mwg Senior Services Blog

Life Insurance Basics Mwg Senior Services Blog

Understand Life Insurance Basics Term Life Insurance Dave

Understand Life Insurance Basics Term Life Insurance Dave

Belum ada Komentar untuk "Term Life Insurance Basics"

Posting Komentar