Term And Whole Life Insurance

At the end of the term you receive no return on the money that you paid for the insurance but if you die before the term is over then your loved ones will receive the full amount of the policy. Term insurance can be at times more cost effective because you only pay for the cost of the insurance cover not cover plus a savings and investment plan as you would have for whole life insurance.

Term Vs Whole Life Insurance Which Is Better With Infographics

Term Vs Whole Life Insurance Which Is Better With Infographics

Find out more by contacting an insurance agent in your area.

Term and whole life insurance. Compare cost and policy features. A term life insurance policy has 3 main components face amo. What are the benefits of term life insurance vs.

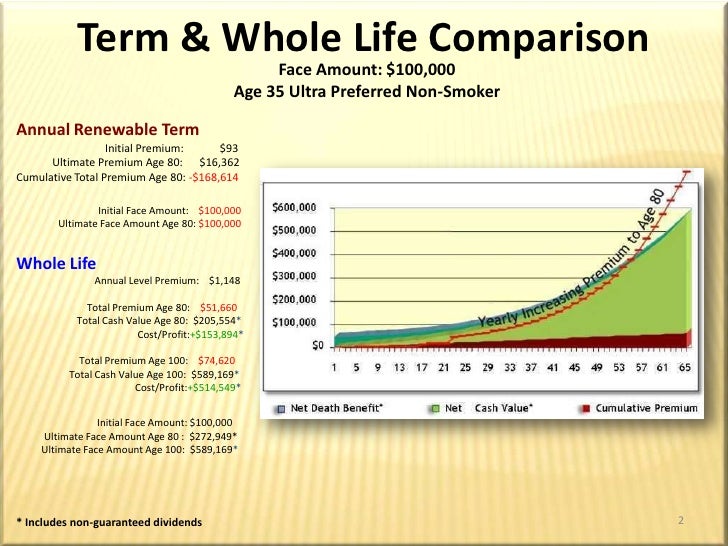

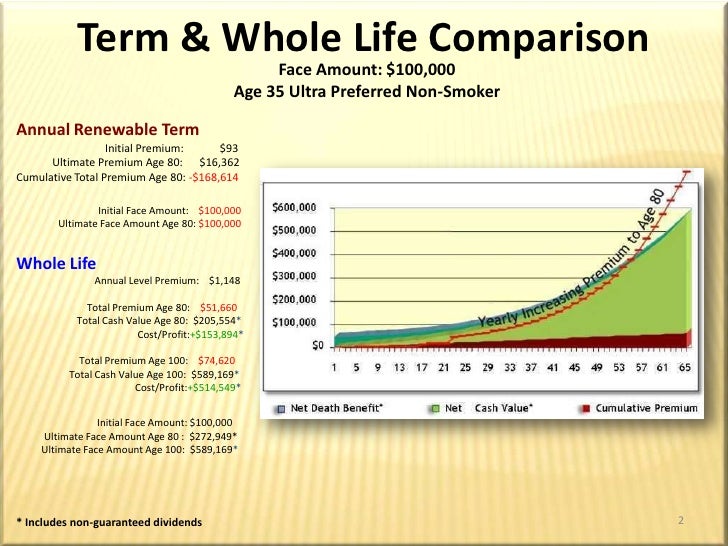

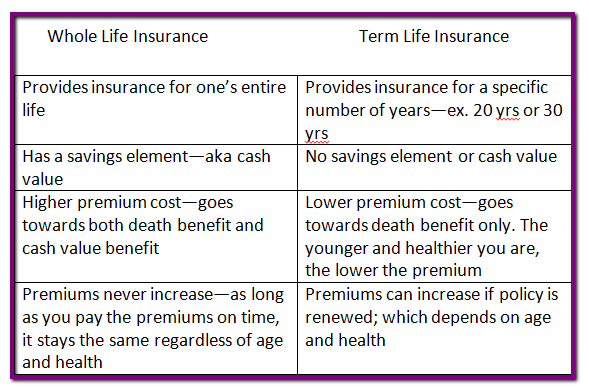

The biggest difference between term and whole life insurance is the length of coverage. Common term whole life insurance definitions. The main difference between term life insurance and whole life insurance is that term life insurance serves as insurance only whereas whole life insurance is actually insurance plus investment.

Term life insurance is purchased for a specific period of time usually from one to twenty years. When considering which type of life insurance you should purchase understanding the basics benefits and realities of both term and whole life insurance is important in making a decision that is best for you. Whole life insurance policies have no expiration date and are more expensive than term life because they.

This is because the term life policy has no cash value until you or your spouse passes away. Term life insurance is good for people who want insurance for specific financial obligations with a known end. Whole life insurance premiums are level they stay the same no matter how long you have the policy.

Term life insurance plans are much more affordable than whole life insurance. There are differences between term and whole life insurance but some concepts are the same across types. Now that you know the differences between term life insurance and whole life insurance you can make an informed choice to find the best life insurance solution for you and your family.

Term life insurance is cheap because its temporary and has no cash value. Whole life insurance costs more because it lasts a lifetime and does have cash value. Whole life insurance is good for people who want their beneficiaries to receive a payout no matter when they pass away.

No matter what type of insurance you choose here are some basic definitions you need to. Term life insurance vs whole life insurance comparison. It has no cash value.

Term insurance can also be reviewed more regularly which allows you to review your circumstances to ensure that youre not over or under insured. In the simplest of terms its not worth anything unless one of you were to die during the course of the term.

Term Life Insurance Vs Whole Life Insurance

Term Life Insurance Vs Whole Life Insurance

Life Insurance Permanent Whole Term Universal Return Of Premium

Life Insurance Permanent Whole Term Universal Return Of Premium

Term Vs Permanent Compelling Reasons For Permanent Insurance

Term Vs Permanent Compelling Reasons For Permanent Insurance

What S The Best Life Insurance Policy To Buy It S Healthy To Be

What S The Best Life Insurance Policy To Buy It S Healthy To Be

Term Insurance Vs Whole Life Insurance Which One You Should Buy

Term Insurance Vs Whole Life Insurance Which One You Should Buy

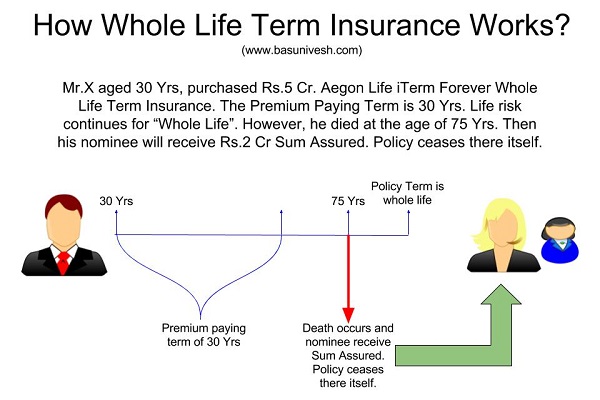

Aegon Life Iterm Forever Whole Life Term Insurance Should You

Aegon Life Iterm Forever Whole Life Term Insurance Should You

Life Insurance Facts Term Life Insurance Versus Whole Life

Life Insurance Facts Term Life Insurance Versus Whole Life

Whole Life Insurance Comparison Chart Parta Innovations2019 Org

Whole Life Insurance Comparison Chart Parta Innovations2019 Org

Term Insurance Vs Whole Life Insurance Policy

Term Insurance Vs Whole Life Insurance Policy

The Differences Between Term And Whole Life Insurance

The Differences Between Term And Whole Life Insurance

Comparing The Cost Of Permanent Term Life Insurance Life Happens

Comparing The Cost Of Permanent Term Life Insurance Life Happens

Term Life Insurance For Diabetics Diabetes 365

Term Life Insurance For Diabetics Diabetes 365

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

Life Insurance Product Comparison Chart With Term And Whole Life

Life Insurance Product Comparison Chart With Term And Whole Life

The Best Life Insurance Companies In 2020 Policygenius

The Best Life Insurance Companies In 2020 Policygenius

Whole Life Vs Term Life Top 10 Differences And Similarities You

Whole Life Vs Term Life Top 10 Differences And Similarities You

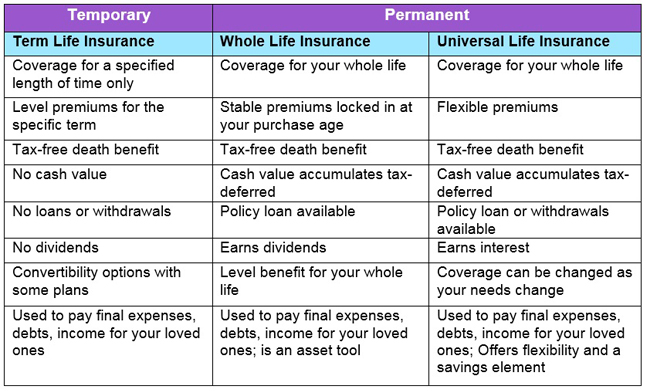

Difference Between Term Universal And Whole Life Insurance

Difference Between Term Universal And Whole Life Insurance

Econnect Woman S Life Insurance Society

Econnect Woman S Life Insurance Society

Whole Life Insurance For Diabetics The Better Choice Than Term

Whole Life Insurance For Diabetics The Better Choice Than Term

Term Life Insurance Vs Whole And Universal Life Insurance Policies

Term Life Insurance Vs Whole And Universal Life Insurance Policies

Term Vs Whole Life Insurance What S The Best Option For You

Term Vs Whole Life Insurance What S The Best Option For You

Pros And Cons Of Whole Life Vs Term Life Insurance The Schwab

Pros And Cons Of Whole Life Vs Term Life Insurance The Schwab

Belum ada Komentar untuk "Term And Whole Life Insurance"

Posting Komentar