Taxable Cost Of Group Term Life Insurance

Group term life insurance is a benefit frequently offered by employers for their employees. Code 79 allows employees to exclude from their gross income the cost of up to 50000 in employer provided group term life insurance coverage.

2015 College For Financial Planning All Rights Reserved Session

2015 College For Financial Planning All Rights Reserved Session

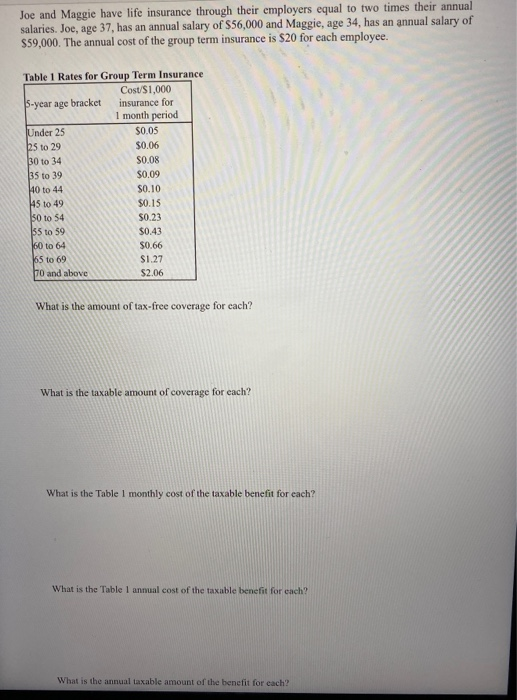

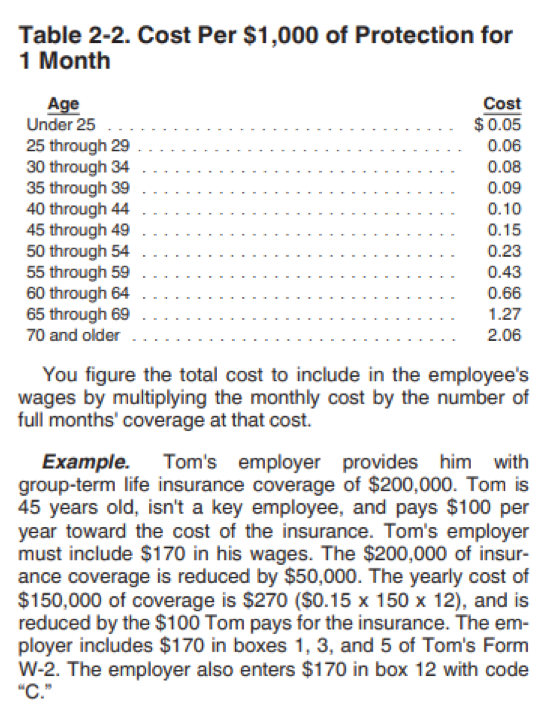

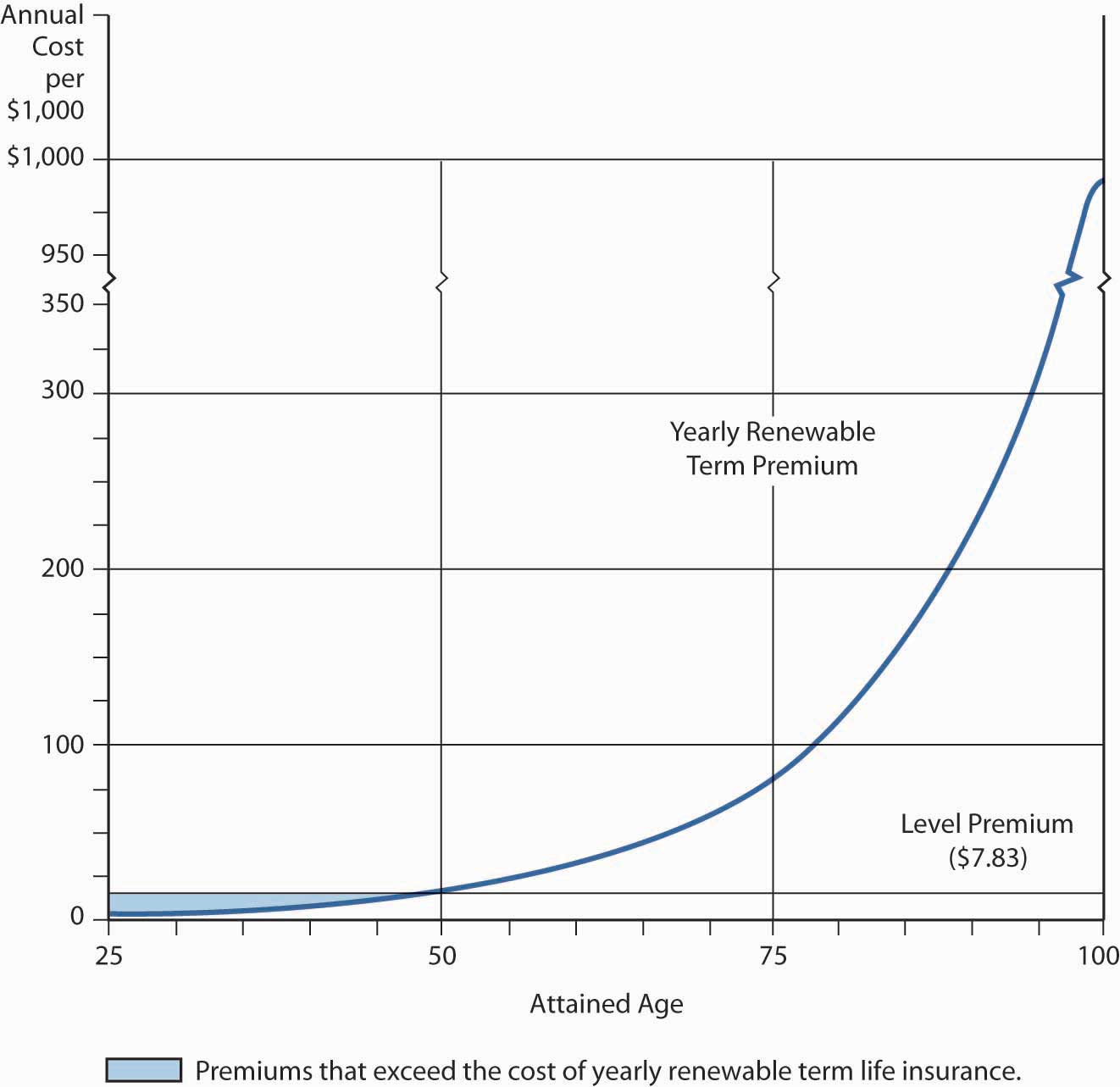

The cost of group term life insurance that exceeds 50000 is based on federal premium tables which provide the cost of each 1000 of excess coverage per month that should be included in federal taxable income of the employee.

Taxable cost of group term life insurance. Group term life insurance irs regulations include in wages the cost of group term life insurance you provided to an employee for more than 50000 of coverage or for coverage that discriminated in favor of the employee. Taxable cost of group term life insurance. On group life insurance that the employer is paying on your behalf is tax free on premiums of the first 50000 face amount.

Thus if your employees purchase no more than 50000 of employer provided group term life insurance coverage with pre tax contributions under your cafeteria plan they will not pay federal taxes on the coverage. This coverage is excluded as a de minimis fringe benefit. The cost depends on how much each employee receives in life insurance coverage and their age.

According to internal revenue service section 79 if an employee receives more than 50000 of group term life insurance under a policy carried by his employer the imputed cost of coverage over 50000 is considered taxable income and is subject to social security and medicare taxes. This amount is subject to social security and medicare taxes but not futa tax or income tax withholding. If you want to know how much to include on your employees form w 2 as taxable income you need to know the cost of group term life insurance.

If you are filing a 1040 tax form as an employee you do not have to add it to your taxes. The cost of employer provided group term life insurance on the life of an employees spouse or dependent paid by the employer is not taxable to the employee if the face amount of the coverage does not exceed 2000. Many employers provide at no cost a base amount of group coverage as well as the ability to purchase.

It currently does not include any additional earnings such as longevity shift overtime etc. Internal revenue service code section 79 requires inclusion in an employee federal and state taxable gross the cost of group term life insurance coverage in excess of 50000 provided to an employee by an employer.

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

How Much Does Life Insurance Cost

How Much Does Life Insurance Cost

Nontaxable Taxable Fringe Benefits A Refresher Benefit Minute

Nontaxable Taxable Fringe Benefits A Refresher Benefit Minute

Joe And Maggie Have Life Insurance Through Their E Chegg Com

Joe And Maggie Have Life Insurance Through Their E Chegg Com

Overview Calculating The Cost Of Group Term Life Insurance

Overview Calculating The Cost Of Group Term Life Insurance

Term Insurance Best Term Plan Policy Online Max Life Insurance

Term Insurance Best Term Plan Policy Online Max Life Insurance

Is Life Insurance Taxable Haven Life

Is Life Insurance Taxable Haven Life

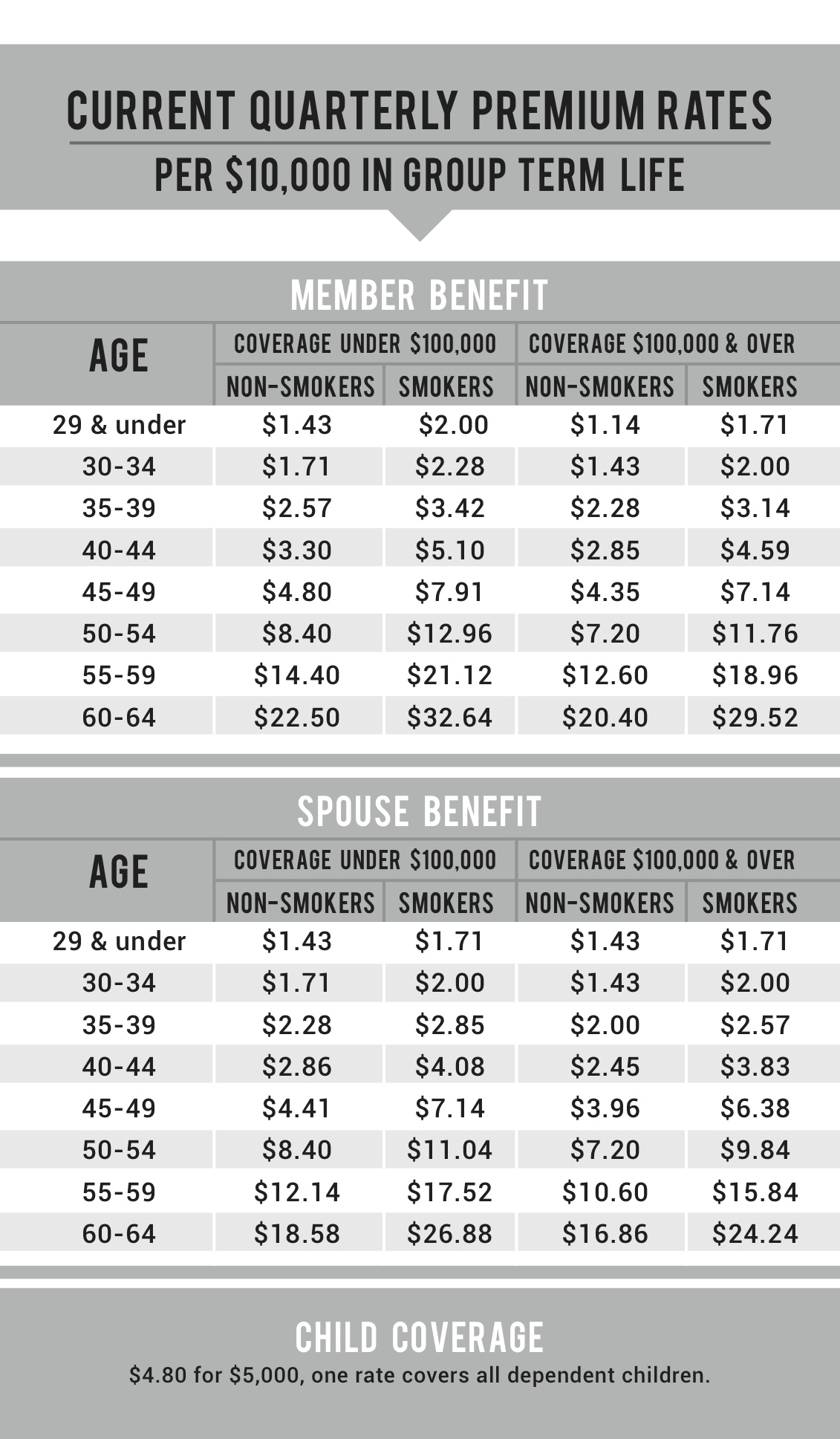

Group Term Life Insurance Mccarthy Stevenot Agency Inc

Group Term Life Insurance Mccarthy Stevenot Agency Inc

Group Term Life Insurance The Aia Trust Where Smart Architects

Group Term Life Insurance The Aia Trust Where Smart Architects

What Is A Section 125 Pop Premium Only Plan Gusto

What Is A Section 125 Pop Premium Only Plan Gusto

Pros And Cons Of Group Life Insurance Through Work

Pros And Cons Of Group Life Insurance Through Work

How To Cancel Your Life Insurance Policy Policygenius

How To Cancel Your Life Insurance Policy Policygenius

Term Insurance Best Term Plans Policy Online In India 2020

Term Insurance Best Term Plans Policy Online In India 2020

Tds Life Insurance Budget 2019 Proposes 5 Tds For Taxable Life

Tds Life Insurance Budget 2019 Proposes 5 Tds For Taxable Life

Mortality Risk Management Individual Life Insurance And Group

Mortality Risk Management Individual Life Insurance And Group

Is Life Insurance Taxable True Blue Life Insurance

Is Life Insurance Taxable True Blue Life Insurance

Quiz Worksheet Group Life Insurance Taxation Study Com

Quiz Worksheet Group Life Insurance Taxation Study Com

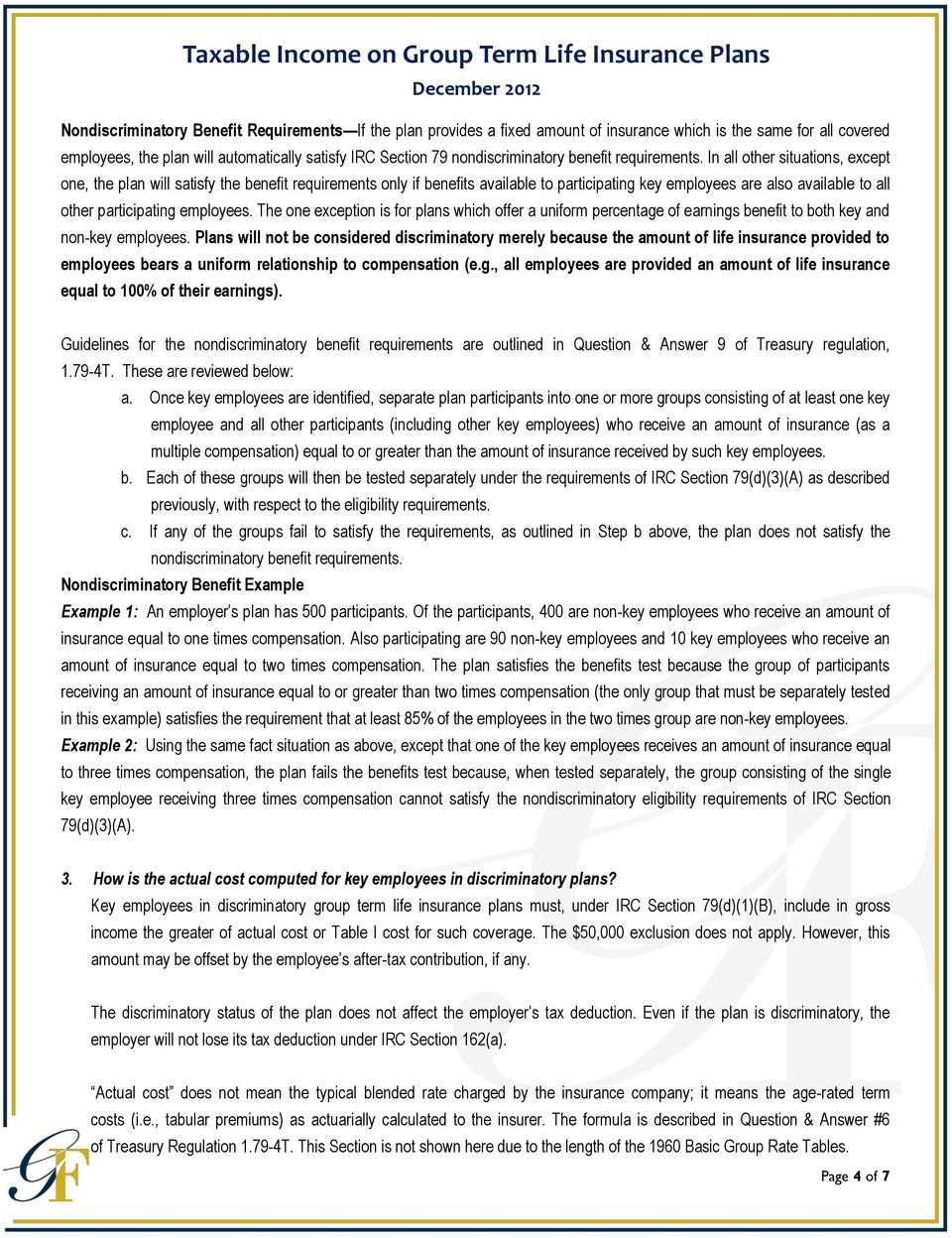

Taxable Income On Group Term Life Insurance Plans Pdf Free Download

Taxable Income On Group Term Life Insurance Plans Pdf Free Download

/shutterstock_161758760-5bfc47aa46e0fb0026623118.jpg)

Belum ada Komentar untuk "Taxable Cost Of Group Term Life Insurance"

Posting Komentar