Tax Implications Of Life Insurance Proceeds

Some life insurance products are designed to be an investment as well as a form of protection. In general the cash reserve within an exempt policy can accumulate on a tax deferred basis and the death benefit payable under the policy is tax free.

Term Insurance Tax Saving Don T Buy Term Insurance Just To Save

Term Insurance Tax Saving Don T Buy Term Insurance Just To Save

Life insurance proceeds are not taxable with respect to income tax so long as the proceeds are paid out entirely as a lump sum one time payment.

Tax implications of life insurance proceeds. These are called endowments or investment plans if you pay regular premiums or investment bonds or single premium bonds if you pay in one or more lump sums. The tax treatment of a life policy is. A life insurance policy loan is not taxable as income as long as it doesnt exceed the amount paid in premiums for the policy.

Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it. This is part two of a series on tax and insurance. Generally life insurance death benefits that are paid out to a beneficiary in a lump sum are not included as income to the recipient of the life insurance payout.

In part one we talked about the tax attributes of life insurance. Generally life insurance proceeds you receive as a beneficiary due to the death of the insured person arent includable in gross income and you dont have to report them. However if your beneficiary receives the life insurance payment as a series of installments the insurer will typically pay interest on the outstanding death benefit.

An even greater advantage is the federal income tax free benefit that life insurance proceeds receive when they are paid to your beneficiary. However any interest you receive is taxable and you should report it as interest received. However while the proceeds are income tax free.

This tax free exclusion also. See topic 403 for more information about interest. If you surrender your policy or your policy lapses the loan plus.

/hispanic-saleswoman-talking-to-clients-in-living-room-580504711-5995f8d722fa3a001149763c.jpg) Life Insurance Death Benefits Estate Tax

Life Insurance Death Benefits Estate Tax

Section 10 10d Of Income Tax Act On Payouts Of Life Insurance

Section 10 10d Of Income Tax Act On Payouts Of Life Insurance

Life Insurance And Estate Tax Presentation

Life Insurance And Estate Tax Presentation

Why A Us Person Should Avoid Foreign Life Insurance Online Taxman

Why A Us Person Should Avoid Foreign Life Insurance Online Taxman

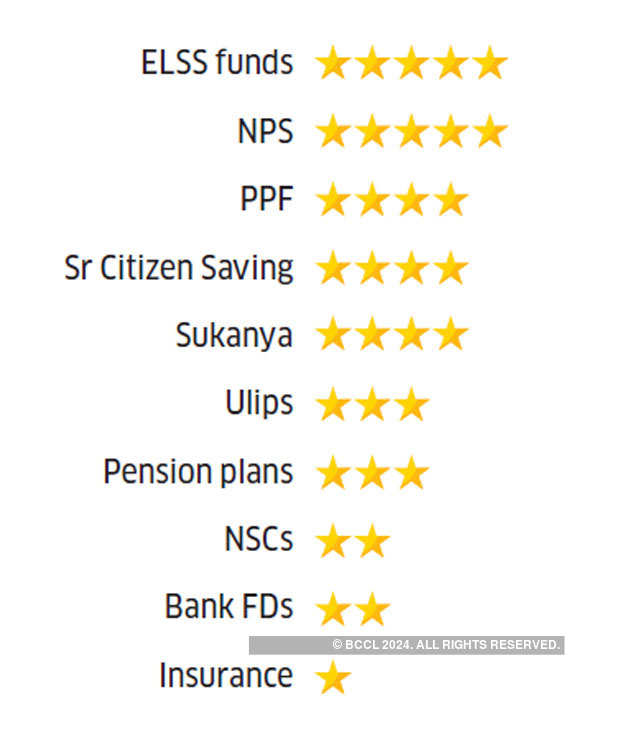

Save Income Tax Best Tax Saving Option For Fy 2018 19 Here S A

Save Income Tax Best Tax Saving Option For Fy 2018 19 Here S A

What Is Tax Liability If I Surrender My Insurance Policy Before

What Is Tax Liability If I Surrender My Insurance Policy Before

2018 Life Viatical Settlement Taxation Guide Life Insurance

2018 Life Viatical Settlement Taxation Guide Life Insurance

102 Best Life Insurance Images Life Insurance Life Insurance

102 Best Life Insurance Images Life Insurance Life Insurance

Modified Endowment Contract Mec Study Com

Modified Endowment Contract Mec Study Com

How To Rescue A Life Insurance Policy With A Loan

How To Rescue A Life Insurance Policy With A Loan

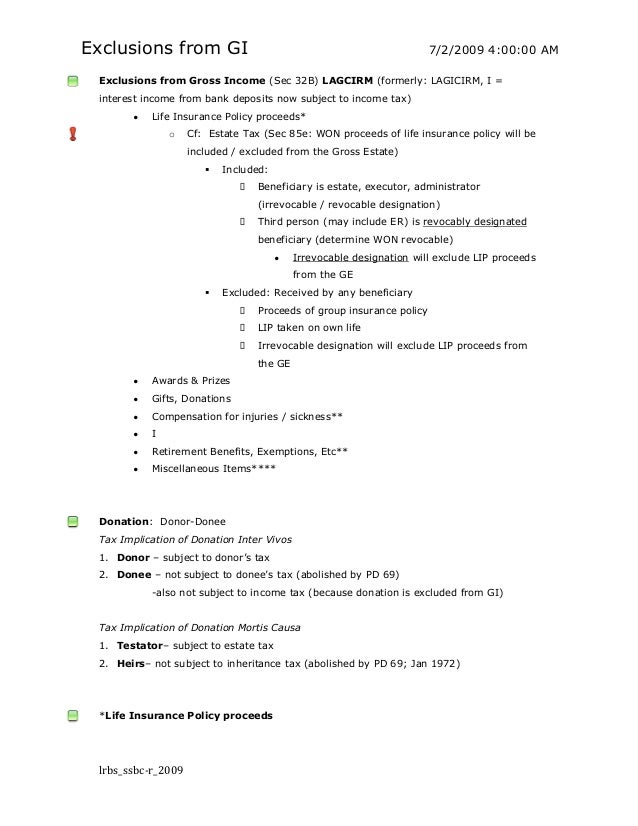

57804336 Tax1 Dimaampao Lecture Notes

57804336 Tax1 Dimaampao Lecture Notes

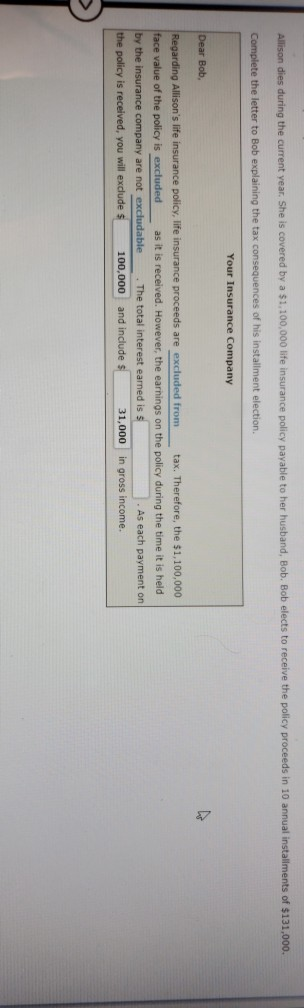

Solved Allison Dies During The Current Year She Is Cover

Solved Allison Dies During The Current Year She Is Cover

How Does A Life Insurance Policy Payout Work Haven Life

How Does A Life Insurance Policy Payout Work Haven Life

:brightness(10):contrast(5):no_upscale()/173867442-56a2ef203df78cf7727b36a1.jpg) What Is An Irrevocable Life Insurance Trust

What Is An Irrevocable Life Insurance Trust

Budget 2019 Tweaks Taxes On Insurance Maturity Proceeds

Budget 2019 Tweaks Taxes On Insurance Maturity Proceeds

Is Life Insurance An Asset Why It May Be The Most Important Asset

Is Life Insurance An Asset Why It May Be The Most Important Asset

Indexed Universal Life Iul Insurance Policies All You Need To

Indexed Universal Life Iul Insurance Policies All You Need To

New Irs Code 101 J Changes Requires Life Insurance Notice And

New Irs Code 101 J Changes Requires Life Insurance Notice And

Ppt Life Insurance In Split Funded Defined Benefit Plans

Ppt Life Insurance In Split Funded Defined Benefit Plans

How To Avoid Taxation On Life Insurance Proceeds

How To Avoid Taxation On Life Insurance Proceeds

Avoid Surrendering Life Insurance Policy 1

Avoid Surrendering Life Insurance Policy 1

Business Insurance Understanding The Tax Implications Pdf Free

Business Insurance Understanding The Tax Implications Pdf Free

Are You Getting Tax Benefits From Your Life Insurance Hdfc Life

Are You Getting Tax Benefits From Your Life Insurance Hdfc Life

Belum ada Komentar untuk "Tax Implications Of Life Insurance Proceeds"

Posting Komentar