Selling Term Life Insurance

To understand why it can be difficult to sell a term life policy it is vital to understand the difference between a term and permanent policy. The truth is that selling a life insurance policy might be a viable alternative in some specific situations and even then it is a complex.

Saver S Select Termsm Ppt Download

Saver S Select Termsm Ppt Download

It may seem like a relatively easy way to get the cash you need quickly but this is not always the case.

Selling term life insurance. Brokers who are successful at selling life insurance online treat. But if youre unable to pay the premiums or no longer need life insurance selling your policy is an optionheres. As you can see there are a lot of factors to consider when selling term life insurance beyond the price.

Buying a permanent life insurance policy is a long term financial commitment. These transactions are commonly called life settlements senior settlements orif the person is terminally illviatical settlements. Selling a term life insurance policy for cash is possible if your policy is convertible into permanent life insurance.

Once converted a life settlement provider can then make an offer based on your age health type of insurance premiums and death benefit. Term and universal policies you make your first sale and garner the majority of the premium for yourself. If youre serious about selling life insurance for a living.

Let excelsior help you navigate the term life insurance market today. Term life insurance settlement. Yes you can sell a term life insurance policy for cash as long as the policy is convertible into permanent life insurance.

A growing number of americans are selling their life insurance policies to get cash for retirement expenses and long term care. A term life policy lasts for a certain period of time. Is more complex than setting up a website and watching the sales notifications roll in.

If a policy with no cash surrender value is sold for example a term life insurance contract the policy premiums would have largely covered just the cost of insurance so that the proceeds received from the sale of the policy would all be capital gains. You may have heard that selling a life insurance policy is a good way to get cash for your retirement medical bills or long term care expenses. When selecting a carrier look for term policies that allow the client to add return of premium waiver of premium or children riders.

How to sell your term life insurance policy for cash. How to sell life insurance online.

Can I Sell My Life Insurance Policy All For Cash Mason Finance

Can I Sell My Life Insurance Policy All For Cash Mason Finance

Permanent Insurance Insurance Frauds Insurance Complaints Mis

Permanent Insurance Insurance Frauds Insurance Complaints Mis

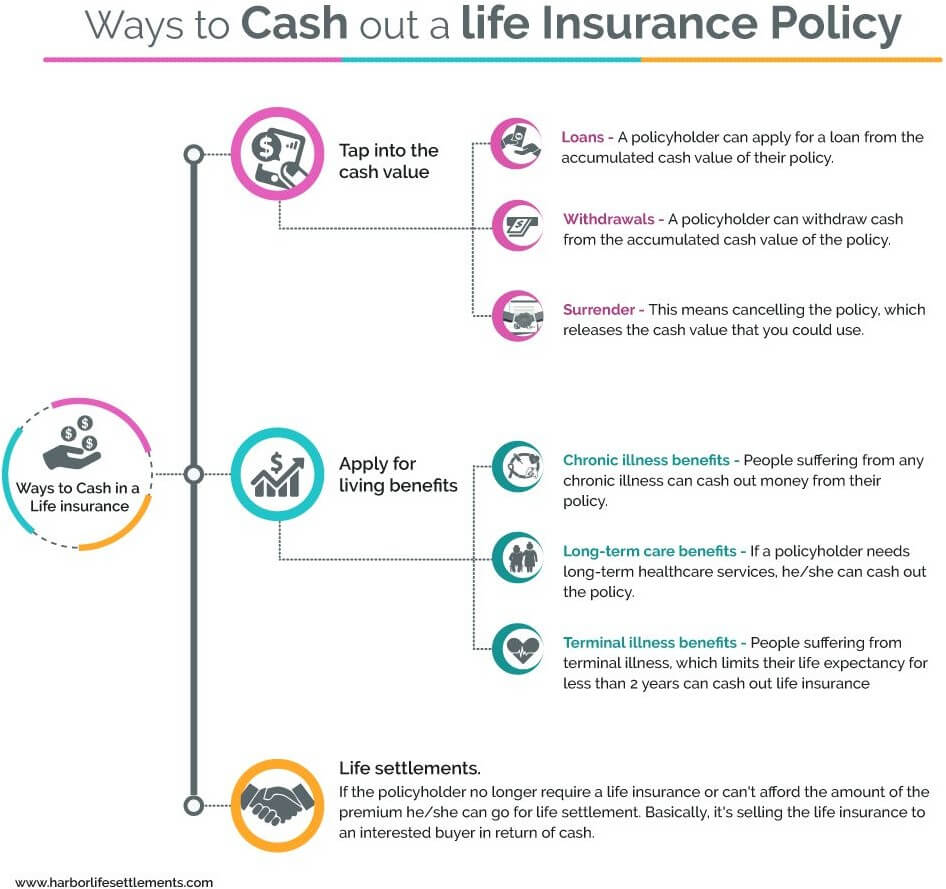

What To Know About Cashing Out Life Insurance Harbor Life

What To Know About Cashing Out Life Insurance Harbor Life

Tata Aia Life Life Insurance Term Insurance Plans Child Plans

Tata Aia Life Life Insurance Term Insurance Plans Child Plans

Good Bye Worries Buy A Life Insurance Policy Using These Tips

Good Bye Worries Buy A Life Insurance Policy Using These Tips

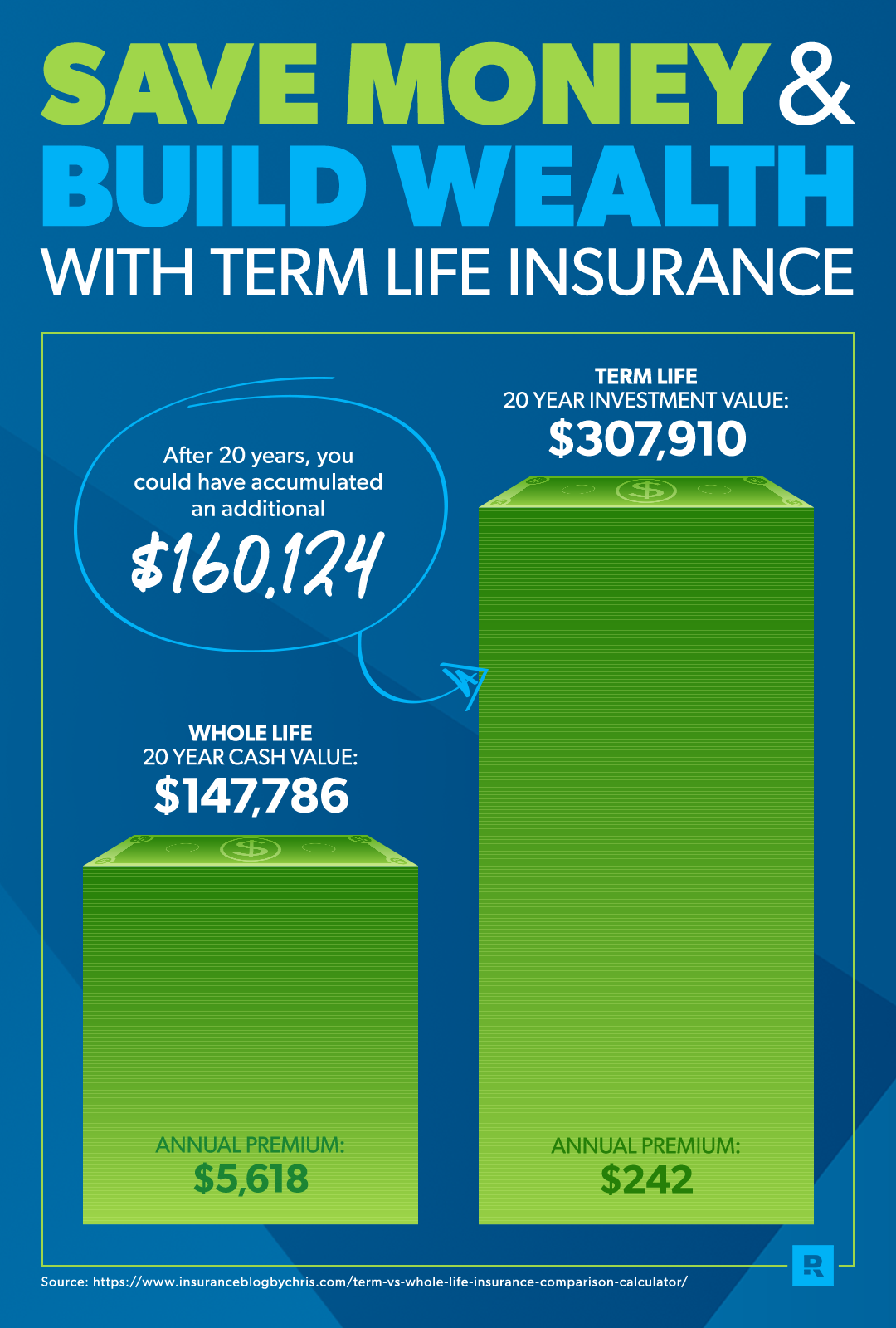

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

Types Of Life Insurance Policies Available In India Risk Benefits

Types Of Life Insurance Policies Available In India Risk Benefits

Can I Sell My Term Life Insurance Policy For Cash Mason Finance

Can I Sell My Term Life Insurance Policy For Cash Mason Finance

/32863956976_0e10da5786_o-457a3aa72d3041288ac916eada5ea83a.jpg) Best Ways To Find Life Insurance Leads

Best Ways To Find Life Insurance Leads

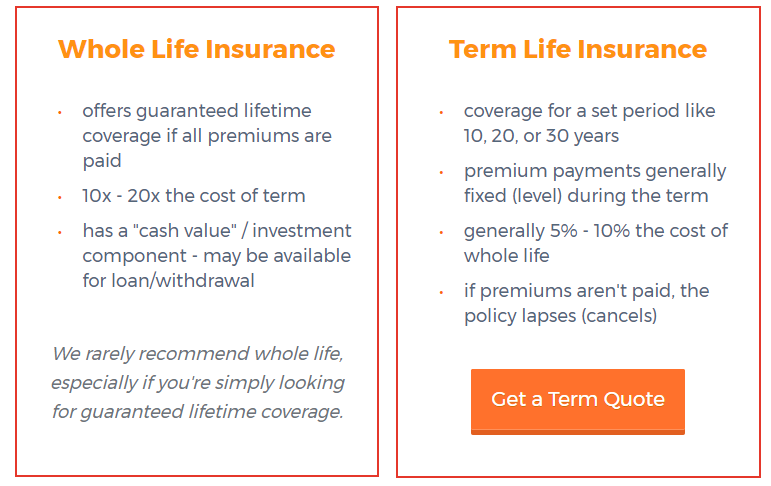

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

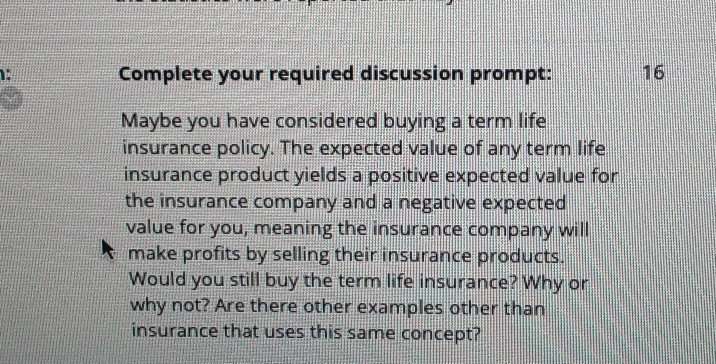

Solved Complete Your Required Discussion Prompt Maybe Yo

Solved Complete Your Required Discussion Prompt Maybe Yo

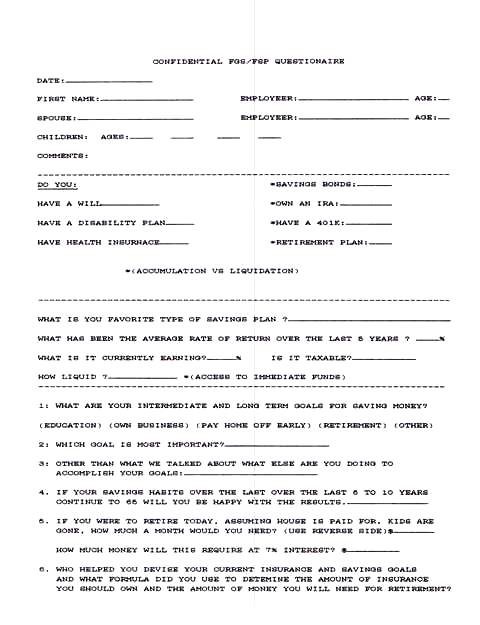

Life Insurance Questionnaire Survey Life Insurance Exam Ny Sample

Life Insurance Questionnaire Survey Life Insurance Exam Ny Sample

Term Insurance Best Term Plans Policy In India 2020 21 Icici

Term Insurance Best Term Plans Policy In India 2020 21 Icici

Ask 20 Seminar For Life Insurance Advisors What S Happening

Ask 20 Seminar For Life Insurance Advisors What S Happening

Life Insurance Irdai Issues New Norms To Curb Life Insurance

Life Insurance Irdai Issues New Norms To Curb Life Insurance

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

Topics For Personal Investment Finance Final Exam

Topics For Personal Investment Finance Final Exam

How To Make 250k Per Year Selling Life Insurance Insurance Pro

How To Make 250k Per Year Selling Life Insurance Insurance Pro

Impact Of Words And Selling Permanent Life Insurance

Impact Of Words And Selling Permanent Life Insurance

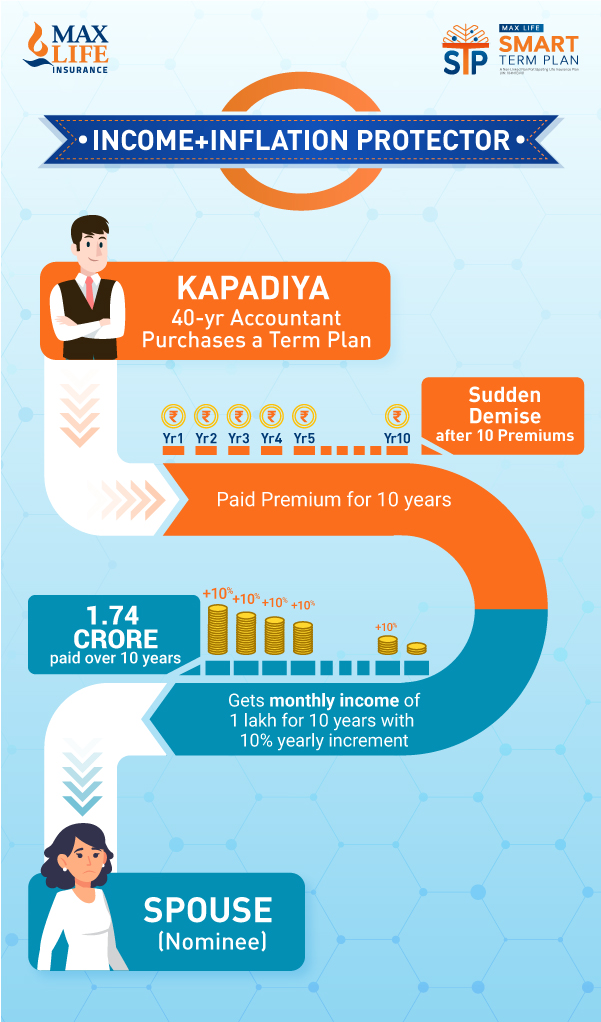

Term Insurance Best Term Plan Policy Online Max Life Insurance

Term Insurance Best Term Plan Policy Online Max Life Insurance

/GettyImages-499760171-5893b7c33df78caebcf8bcde.jpg)

Belum ada Komentar untuk "Selling Term Life Insurance"

Posting Komentar