Term Life Insurance Vs Whole Life Insurance

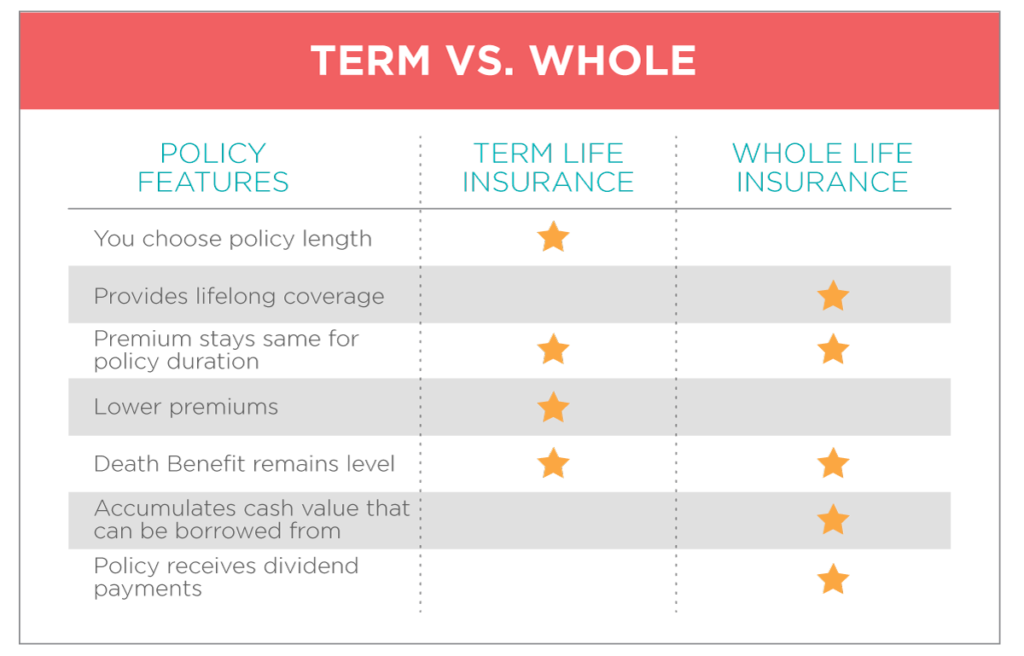

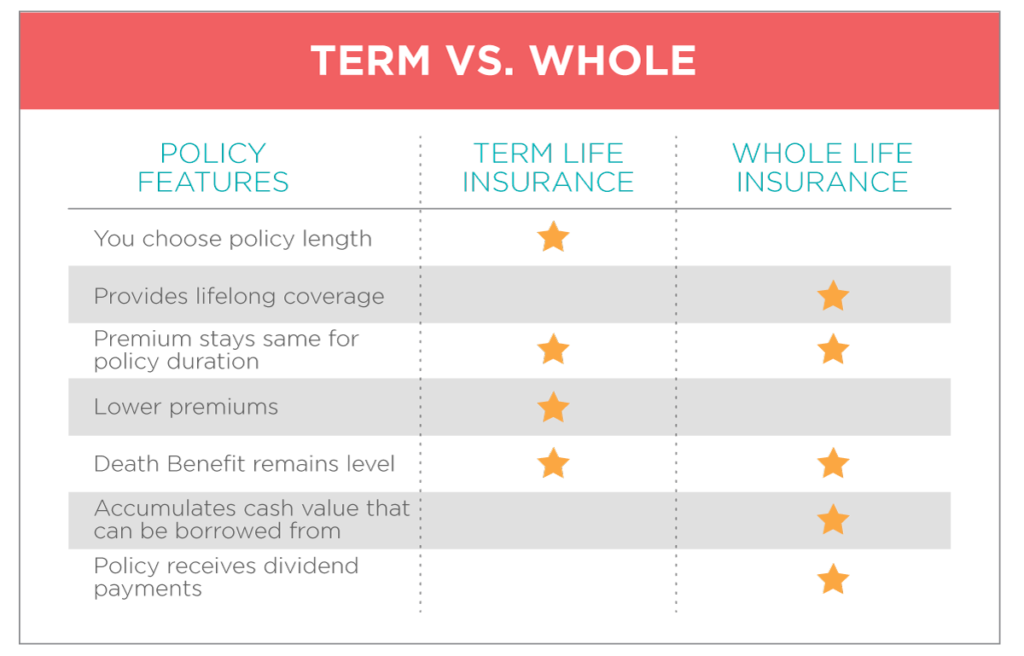

Compare cost and policy features. Choosing term life versus whole life insurance depends on your budget and needs.

Term Life Insurance And Whole Life Insurance Quotes For Your Family

Term Life Insurance And Whole Life Insurance Quotes For Your Family

But most people can start shopping by making one key decision.

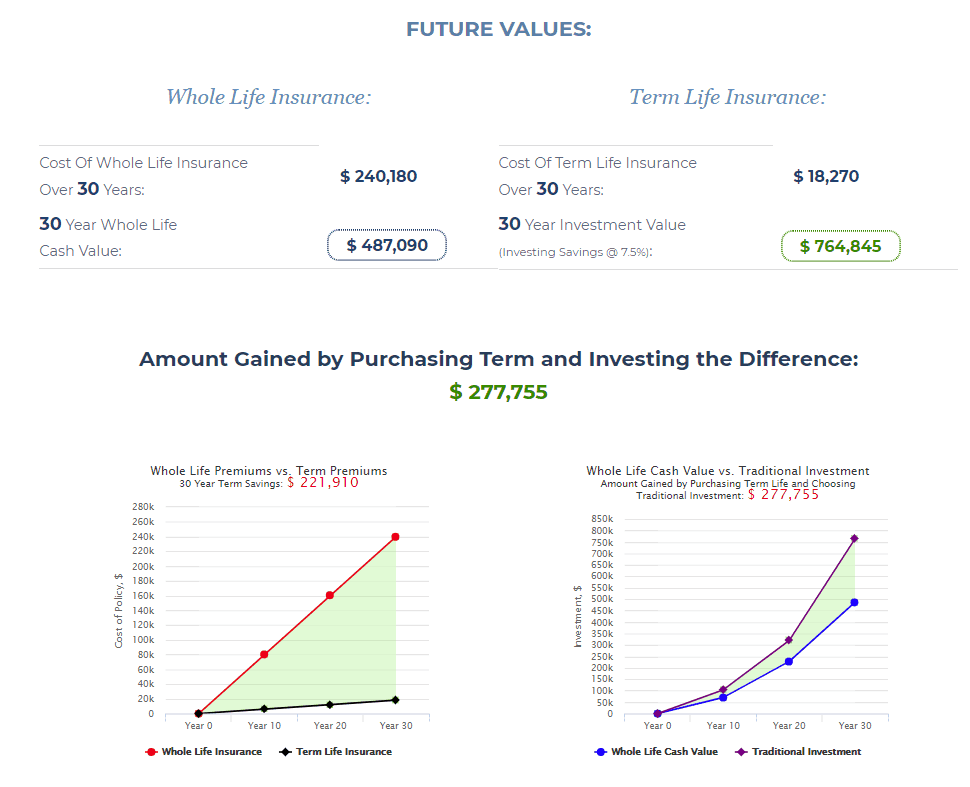

Term life insurance vs whole life insurance. Term life insurance vs. Whole life insurance is good for people who want their beneficiaries to receive a payout no matter when they pass away. By neal frankle cfp the article represents the authors opinionthis post may contain affiliate links.

Buying life insurance seems daunting. Its always going to be the most affordable and give you much more coverage for the price. Good financial decision making is based on solid research and sound advice.

Term life insurance is very affordable and ensures a death benefit for a set term typically 10 to 30 years. Whether you should buy term life insurance whole life insurance universal life insurance or more than one type is up to you. Now that you know the differences between term life insurance and whole life insurance you can make an informed choice to find the best life insurance solution for you and your family.

Term life insurance is affordable and straightforward while whole life doesnt expire but is more expensive. Whole life insurance costs more because it lasts a lifetime and does have cash value. Both types have their benefits and drawbacks.

Find out more by contacting an insurance agent in your area. Do you need term life insurance or whole life insurance. It has no cash value.

Please read our disclosure for more info. Term life insurance is good for people who want insurance for specific financial obligations with a known end. Whole life insurance in plain english.

Term life insurance is cheap because its temporary and has no cash value. If youre considering term life insurance vs. The grief of losing a member is difficult to forgo but his financial responsibilities can be transferred to something called insurance in general and lifeterm insurance in particular.

When it comes to term life insurance vs whole life insurance i would choose term life. Whole life insurance is more expensive builds a cash value and lasts your entire life as long as you pay your premium. If you have ever wondered how much does life insurance cost then you should only consider term life.

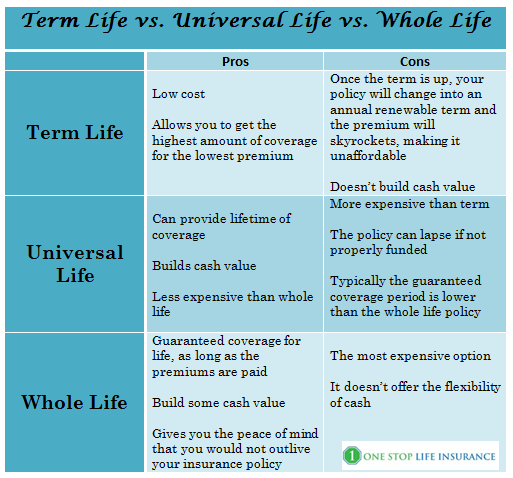

Being informed and knowing the differences and benefits of term vs whole life insurance vs universal life insurance is the best place to start. Whole life insurance be sure to discuss your options with a state farm agent and consult your tax and legal advisor regarding your situation. One needs clear understanding about the types of insurance term insurance vs whole life insurance before actually opting for insurance.

Learning English In Ohio Term Vs Whole Life Insurance

Learning English In Ohio Term Vs Whole Life Insurance

Whole Life Insurance Complex Ingenious

Whole Life Insurance Complex Ingenious

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

Search Q Whole Life Insurance Definition Tbm Isch

Term Insurance Vs Whole Life Insurance Policy

Term Insurance Vs Whole Life Insurance Policy

Difference Between Annuity And Life Insurance Difference Between

Difference Between Annuity And Life Insurance Difference Between

Difference Between Term Universal And Whole Life Insurance

Difference Between Term Universal And Whole Life Insurance

Term Life Insurance Vs Whole Life Insurance Information For Parents

Term Life Insurance Vs Whole Life Insurance Information For Parents

Term Life Insurance Vs Whole Life Insurance Visual Ly

Term Life Insurance Vs Whole Life Insurance Visual Ly

Life Insurance Term Versus Whole Waepa

Life Insurance Term Versus Whole Waepa

Term Life Insurance Lifeline Solutions

Term Life Insurance Lifeline Solutions

Term Life Vs Whole Life Insurance Which Is Right For You

Term Life Vs Whole Life Insurance Which Is Right For You

Life Insurance Corridor Benefits

Life Insurance Corridor Benefits

Whole Life Term Insurance Vs Regular Term Life Insurance Which Is

Whole Life Term Insurance Vs Regular Term Life Insurance Which Is

Compare Life Insurance Options Term Vs Whole Life

Compare Life Insurance Options Term Vs Whole Life

Term Vs Wl Vs Ul One Stop Life Insurance

Term Vs Wl Vs Ul One Stop Life Insurance

Term Life Insurance For Diabetics Diabetes 365

Term Life Insurance For Diabetics Diabetes 365

Comparing The Cost Of Permanent Term Life Insurance Life Happens

Comparing The Cost Of Permanent Term Life Insurance Life Happens

Term Insurance Vs Whole Life Insurance What Is Insurance How

Term Insurance Vs Whole Life Insurance What Is Insurance How

Belum ada Komentar untuk "Term Life Insurance Vs Whole Life Insurance"

Posting Komentar